- May 18 2022

- Fast Focus Policy Brief No. 59-2021

New research asks whether direct cash payments to people living in poverty, particularly for households with children, effectively improve child development outcomes into adulthood.[1] About 20% of U.S. American children grow up in poverty,[2] and family income during early childhood is strongly associated with educational attainment and other social and economic outcomes. It can be difficult to separate the effects of family resources, however, from other aspects of a child’s early life, including family structure and stability, parenting styles, and the qualities of a neighborhood and schools.

Researchers Andrew Barr, Jonathan Eggleston, and Alexander A. Smith[3] seek to understand the effectiveness of unrestricted cash support for families facing economic hardship by estimating the long-run causal effects of cash transfers immediately after the birth of a first child. Their work takes advantage of linked-data that track multiple cohorts of low-income parents and their first-born children. These data allow the researchers to follow infants into adulthood and assess the social and economic effects of a relatively modest cash disbursement in very early childhood.

A Natural Experiment Based on The Timing of a First Birth

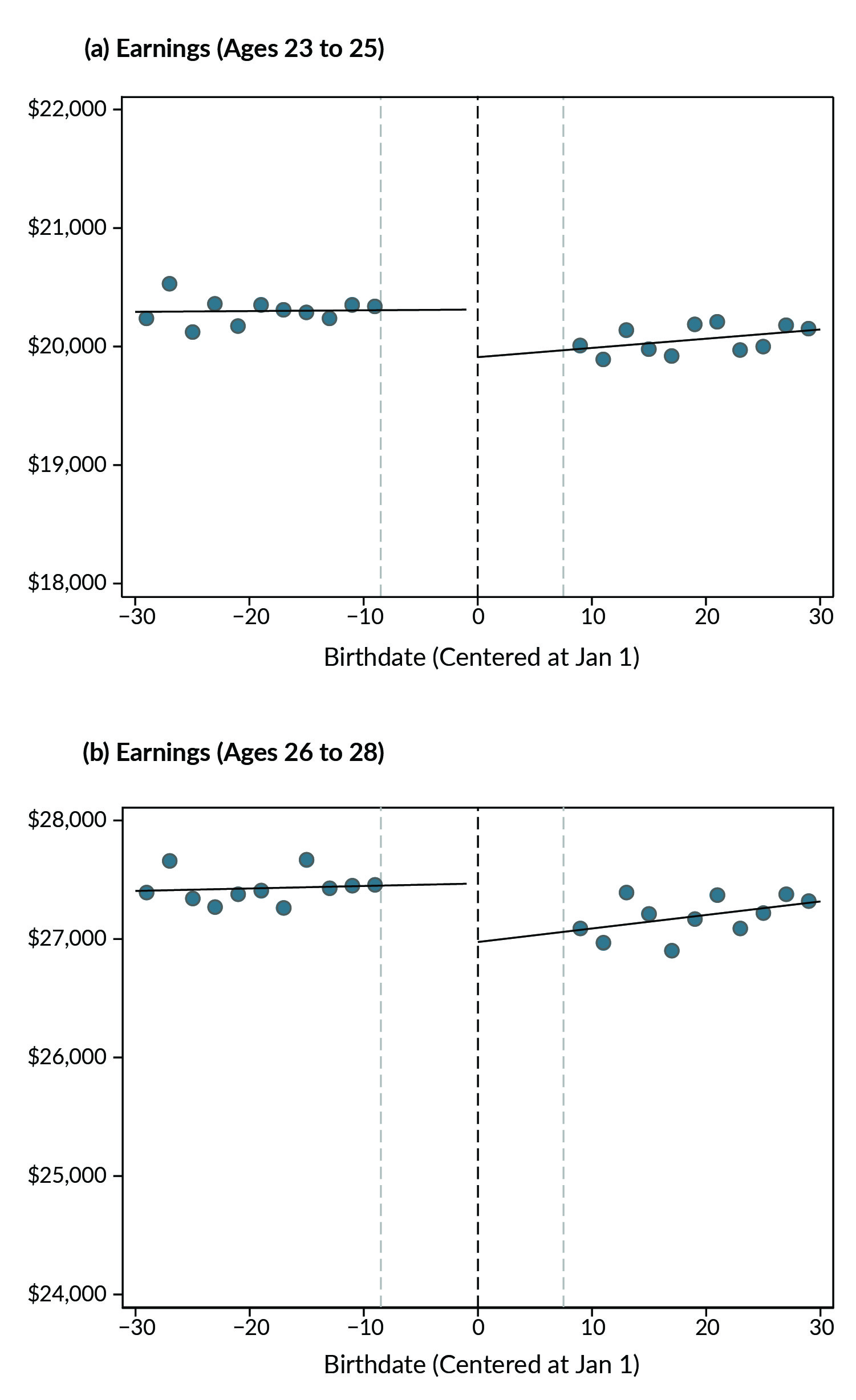

Note: Earnings outcomes are constructed as a three-year average of earnings. For details on variable construction, sample restrictions, etc. visit the source paper below.

Source: Barr, A., Eggleston, J. and Smith, A. A. (2022). Investing in infants: The lasting effects of cash transfers to new families. The Quarterly Journal of Economics, qjac023.

Due to the structure of the U.S. tax system, a few days difference in the birth date of a child can have a significant financial impact on parents. That’s because families with children born just before the end of a calendar year are eligible to receive the Earned Income Tax Credit (EITC) and (until recently) the dependent deduction on income taxes within the first year of the child’s life. In contrast, the parents of a child born just after January 1st are not eligible for this support until the following calendar/tax year.

Barr, Eggleston, and Smith focused on birth cohorts born in 1981–82, 1985–86, and 1991–92 due to the availability of linked tax data, which allowed them to focus their analyses on families likely to be eligible for the EITC. The researchers then tracked the data on those children, including their tax filings as adults, to compare outcomes such as wage earnings for those born just before or just after January 1st.

For families living below the poverty threshold, the EITC and dependent exemption in the 1980s and early 1990s averaged roughly $1,300, or about 10 percent of household income in that initial year. That means the families into which babies were born before the January 1 cut-off were at a considerable advantage during an often-stressful period for new families—the baby’s first year—compared to their peers in otherwise similar families with babies born just slightly later.

Findings

A cash transfer during infancy can have profound and long-lasting effects, including educational, behavioral, and economic or labor market advantages.

Researchers in this study found that children who grew up in the immediate-eligibility families (compared to those children in families who were only able to file for an EITC in the following year) were earning on average about 1 to 2 percent more at ages 23–28. In addition, for the subset of the sample that researchers can follow into their 30s, there are indications of similar or perhaps even larger effect sizes; in age cohorts of 29–31 and 32–34 years old, the increase in earnings was 2 to 3 percent.

The data also suggest that males may benefit more than females. For males, the researchers found a consistent two to three percent increase in earnings per $1,000 that their parents received during their child’s infancy. This finding is consistent with other research indicating that boys’ development is particularly sensitive to the early childhood environment and availability of resources.[4] There was not clear evidence of differences according to race or other demographic factors.

Further evidence of the first-year cash transfer’s impacts on later earnings is seen by focusing on the 1991–92 cohort. The EITC transfer amount was higher for this group—$1,808, or nearly twice that received by the earlier cohorts in this study. For the individuals in the early 1990s cohort, an effect of approximately $665 per year (3.4 percent) was noted at age 23–25, and $687 per year (2.6 percent) at ages 26–28.

At the family level, researchers find that receiving additional financial supports during the first year of a baby’s life results in increased overall household income over time. By examining tax filings of parents who received the tax credit earlier, there is evidence of an approximately four percent, or about $1,000, increase in household income three and four years after the child’s birth. While there is not a discernible shift towards marriage, there appears to be a lower rate of parents moving out of their relationships, suggesting greater stability and more income for the household over time. These factors may benefit not only the parents and first-born child, but other members of the household as well.

Using separate administrative education data from North Carolina, evidence from this study also suggests that the children whose families received the immediate first-year benefits experienced positive educational and behavioral effects. These outcomes include higher standardized test scores in grades 3–8 along with fewer suspensions and higher high school graduation rates.

Important caveats of these results are that they do not speak to the effect of a cash transfer for non-first-born children, for higher income families, or for families with zero prior income who therefore do not receive the tax benefits. Additionally, this research does not examine differences across potential cash transfers available at later points in a child’s life.

What Explains These Effects?

The first year of a child’s life represents significant changes for any family, and low-resource households face many more challenges than those with greater means. Provision of an unrestricted cash transfer can help alleviate stressors like reduced incomes due to health concerns or lack of childcare, increased expenses which begin even before birth, and adverse events that might include eviction and other types of housing instability, loss of reliable transportation, or food insecurity. And even short-term stressors can have long-term effects on parents, children, and households.

Relatively modest cash transfers such as the EITC can provide a resource buffer that allows new families to avoid typical negative financial shocks. In combination with subsequent increases in earnings, this may allow for more resources to support babies’ physical, cognitive, and emotional development. These can include improved nutrition and access to better healthcare, childcare, and educational opportunities. There may also be some question as to whether this specific cash transfer arising from the EITC may directly encourage parent work. Additional analyses by the authors suggest that this was unlikely to play an important role.

As noted above, the data show that the unrestricted financial supports amounted to an average of $1,300, which equaled roughly 10 percent of the average household’s income in the baby’s first year. While that amount represents only 0.2 percent of the family’s lifetime income, it appears to act as a catalyst for more robust child development outcomes. That such a small amount over the course of a family’s history can produce significant and long-lasting effects for the child and later adult points to the importance of even modest supports during the earliest period in a child’s life.

Policy Implications

Low-income parents of a child born on either side of the tax credit cut-off likely receive similar benefit amounts over the years of the child’s life to adulthood, with simply a one-year shift of when benefits start and end. Yet parents and children who fall before the cut-off clearly benefit compared to their later-born peers. The window of time in which a cash transfer is provided—in this case, during the first year after the birth of a baby—has a significant impact on how much the family benefits in both the short and long term. As a result, adjusting programs so that new parents receive such support sooner can significantly expand positive outcomes to more households facing economic insecurity.

Provision of EITC payments and dependent deductions on income tax filings represent an expenditure by the federal government. This study and others[5] have found, however, that early investments are often more than offset by the tax revenue generated when the infants’ whose families received the added payments grow up and have a higher income (thus higher tax revenue) than their lower-earning counterparts. In fact, in the long run the government coffers benefit from providing the modest supports to families immediately in the baby’s first year of life.

[1]Troller-Renfree, S. V., Costanzo, M. A., Duncan, G. J., Magnuson, K. M., Gennetian, L. A., Hirokazu, Y., Halpern-Meekin, S., Fox, N. A., and Noble, K. G. (2022). The impact of a poverty reduction intervention on infant brain activity. Proceedings of the National Academy of Sciences, 119(5), e2115649119.

[2]About 13,353,000 (22%) of U.S. American children were living in poverty in 2019. Kids Count Data Book: 2019 State Trends in Child Well-Being. (2019, June). Annie E. Casey Foundation.

[3]Barr, A., Eggleston, J., and Smith, A. A. (2022). Investing in infants: The lasting effects of cash transfers to new families. The Quarterly Journal of Economics, qjac023.

[4]Autor, D., Figlio, D., Karbownik, K., Roth, J., and Wasserman, M. (2019). Family disadvantage and the gender gap in behavioral and educational outcomes. American Economic Journal: Applied Economics, 11(3), 338-381. Bertrand, M. & Pan, J. (2013). The trouble with boys: Social influences and the gender gap in disruptive behavior. American Economic Journal: Applied Economics, 5(1), 32–64.

[5]Hendren, N. and Sprung-Keyser, B. (2020). A unified welfare analysis of government policies. The Quarterly Journal of Economics, 135(3), 1209–1318.

Categories

Child Development & Well-Being, Children, Economic Support, Economic Support General, Education & Training, Employment, Family & Partnering, K-12 Education, Labor Market, Parenting